Omagh Bomb 25th Anniversary

Submission

To

Public Inquiry Omagh Bomb 15 August, 1998

From

Vincent McKenna BSSc PGDipSSc MSc Certified Digital Marketing Professional

I, Vincent McKenna, Certified Digital Marketing Professional, being 18 years and upward make Oath and say as follows:

Families Against Intimidation and Terror 1998

From the PIRA Army Convention in Donegal in October, 1997 to end of February, 1998 when my cousin Seamus McKenna constantly told me that the Sinn Fein/PIRA Leadership, namely, Thomas 'Slab' Murphy, Kevin McKenna and Martin McGuinness were allowing the Real IRA to empty PIRA Arms dumps, I had met with and challenged my cousin Kevin McKenna (PIRA Chief of Staff, 1983-1997). At the end of February, 1998, I had already taken a firm stand against Sinn Fein/PIRA in Belfast, however, Kevin McKenna believed he could bring me back in from the cold.

I drove again to meet with Kevin McKenna in Smithborough, County Monaghan. Kevin McKenna asked me to drive to a shed outside Oldcastle in County Meath. Kevin directed me to the location, but never disclosed the reason for travelling there on our journey. I had no idea what was going to happen when we reached the location, I could have been tortured and murdered, I simply did not know. When we reached our destination, we entered a shed and we were met by Michael McKevitt and Seamus McGrane, both founding members of the Real IRA, which was still in its embryotic stages.

Kevin McKenna had a forthright conversation with Michael and Seamus, however, they were not prepared to wait any longer on Gerry Adams to deliver an agreed settlement with the British Government which would include the abandonment of Articles 2 and 3 of Bunreacht na hEireann (Irish Constitution) and still leave the British with a veto over the constitutional future of Northern Ireland. On this occasion, Kevin McKenna did not challenge Michael McKevitt about emptying PIRA arms dumps. In the 1970s two young men who had allegedly misused a single Provisional IRA gun had been brought from Belfast to a house at Park Street, Monaghan Town, later murdered and secretly buried by the Provisional IRA for taking the weapon without authority.

In 1982, Provisional IRA members, Colm Lynagh and Barry Kerr took a Provisional IRA weapon without permission and murdered an innocent civilian Gabriel Murphy in Emyvale, and no action was taken by the Provisional IRA as Colm Lynagh's brother, Jim Lynagh was a high ranking member of the Provisional IRA. The Provisional IRA were flexible when it suited their agenda.

When we left the meeting with Michael and Seamus, I asked Kevin McKenna what he was going to do about Michael emptying PIRA arms dumps and Kevin said:

"The odd bomb going off here and there will keep unionists focused on working with the doves".

As we drove away for this meeting outside Oldcastle, Kevin McKenna asked me to drive him to Mullagh in County Cavan, a short distance from our meeting with Michael McKevitt and Seamus McGrane. When we reached a house in Mullagh, Kevin told me to park the car and stay in the car. I thought this was all very strange. Shortly afterwards Kevin McKenna returned to the car and I drove him back to Smithborough, on the journey to Smithborough I told Kevin that I would go against them for using the Real IRA as proxies, Kevin kept asking me to wait and see how things developed in Belfast before doing anything too dramatic.

When I returned to Belfast, I phoned Garda Detective, Liam Donnelly in Monaghan Town and told him about my journey with Kevin McKenna. I told Liam that I thought the stop at the house in Mullagh was important, as Kevin would never have indicated such a house in the past, certainly not a house that I was not familiar with. A couple of days after Kevin McKenna and I visited the house in Mullagh, Gardai raided the house and arrested a heavily armed Kevin Walsh who had murdered Garda Jerry McCabe in 1996 and had been On-The-Run from 1996 to March, 1998.

I arranged to meet with Martin McGuinness at a Safe-House on the Culmore Road in Derry and Martin was of the same mind as Kevin McKenna:

"The odd bomb going off here and there would keep the unionists focused on working with the doves".

On the 29 March, 1998, I agreed to do a front page interview with Liam Clarke, for The Sunday Times, this at a time when Thomas 'Slab' Murphy, PIRA Chief of Staff, had taken a civil action against The Sunday Times in The High Court in Dublin. I explained how Martin McGuinness had sanctioned an official policy of Ethnic Cleansing in 1986. McGuinness was arrested by Gardai after this meeting in Monaghan in 1986, however, Gardai later advised me that MI6 had sought Martin's release without charge and Garda HQ had directed Gardai in Monaghan Town to release McGuinness.

Soon after my front page interview with The Sunday Times, an interview for which I was allegedly 'sentenced' to death by The PIRA Army Council, I entered Families Against Intimidation and Terror.

On April 17, 1998, rumors began to be directed from Sinn Fein/PIRA Informers and Rapists in Monaghan Town that I had sexually abused a child in Monaghan Town in the 1980s, these rumors picked up by Sinn Fein/PIRA Informers and Rapists in Belfast such as Dennis Donaldson, Freddie Scappitticci, Liam Adams and so forth, and feed to Sinn Fein/PIRA proxies in the media in order to shut down my exposing of Sinn Fein/PIRA's continued criminality.

Sinn Fein Press Statement, 1999, "At no time has Sinn Fein named Vincent McKenna as a suspect in relation to allegations of sexual abuse in Monaghan, such naming would deny such a suspect a fair trial"...https://www.anphoblacht.com/contents/5427

Following the ‘Secret’ Sinn Fein/PIRA Convention in Donegal in October, 1997, which voted to continue to back Gerry Adams and the fledgling peace process, Michael McKevitt who was PIRA Quarter-master on the PIRA Army Council and others walked away from the Adams Project.

Vincent McKenna Autobiography

When my cousin Seamus McKenna (Continuity IRA) told me that the Sinn Fein/PIRA Leadership were allowing McKevitt and others to empty PIRA arms dumps, I challenged my cousin, PIRA Chief of Staff, Kevin McKenna and Head of PIRA Northern Command, Martin McGuinness.

Kevin McKenna and Martin McGuinness were of one-mind:

“The odd bomb going off here and there will keep Unionists focused on working with the Doves”.

The Sinn Fein/PIRA Leadership had decided to use the Real IRA as Proxies to bomb Unionists into a power-sharing Executive at Stormont.

Following this duplicity, I walked away from my role in the peace process. I had worked for many years to bring about the surrender of the Provisional IRA and I was not going to support a process that would allow Terrorism to continue in any form.

War on Duplicity

Following my front-page interview with Liam Clarke for The Sunday Times, in which I explained how an official policy of Ethnic Cleansing had been operationalised by the Sinn Fein/PIRA Leadership in 1986, I was asked by Liam Clarke if I would go into FAIT as it was about to close.

I was reluctant to go into FAIT as a short time earlier, I had been threatened with legal action by FAIT when I had stated in The Irish News that FAIT was a front for Criminals. I contacted Garda Detective, Liam Donnelly in Monaghan and told him that I had been asked to go into FAIT, Garda Detective, Liam Donnelly told me to take up the offer as Sam Cushnahan was known to Garda Special Branch Officer, John McCoy and Cushnahan was believed to be associated with Loyalist terrorists who could pose a threat to the peace process and in particular with bomb attacks in The Irish Republic.

Letter published in The Irish News January 11, 1996.

Letter published in The Irish News, January 19, 1996.

I got back to Liam Clarke and told him that I would go into FAIT. I agreed to meet with Sam Cushnahan at the FAIT office on High Street. While Sam may have believed that everyone knew who he was, I had no clue. Sam told me that he knew that allegations had been made against me in Monaghan as Sinn Fein/Provisional IRA were using the allegations to discredit my work.

Sam Cushnahan told me not to worry about the allegations as he had been through the same thing himself, Sam claimed that a 12-year-old boy had threatened to report him (Sam) to the RUC for sexual abuse, Sam clinched his teeth and said he (the child) never got a chance.

As explained in this document, my focus and instruction, was to get on the inside of FAIT to establish certain facts about certain Terrorists who posed a threat to the peace process. While people believed that my high-profile work on continued violence was my primary objective, it was not, this campaign was useful to keep pressure on Sinn Fein/PIRA and their Proxies, however, my covert work was much more important.

At this time, 1998, Sam Cushnahan was facing bankruptcy, I helped him put a loan application together for 20K that would be co-signed by his brother John Cushnahan, John was a politician in The Irish Republic. As Sam began to confide in me more and more, and became more and more dependent on me for money, I would discover that Sam was in 1998 involved in two extra-marital affairs, one was with the mother of the 12-year-old boy who had committed ‘suicide’, I genuinely never established if Sam was involved with the mother before the child’s death or after.

Sam was also in a Homosexual relationship with a male Journalist in BBC NI, I know this, not simply because Sam told me, but because on one of the occasions Sam asked me for the ‘loan’ of some money to buy wine for his Mistress, I went with Sam to his Mistress’s house in East Belfast (I sat in the car) and Sam gave his Mistress the wine. Sam then drove to Linen-hall Street in Belfast to pick up his Homosexual partner, who had just finished his shift in BBC NI, all very weird. I would rather not name the Journalist as he was a married man at that time, or at least that is what Sam said.

Sam then set about telling me about brothels that he and senior loyalist paramilitaries were fronting. Sam said that FRU used the brothels to recruit sexual deviants within Sinn Fein/PIRA by covertly recording them with under-age boys/girls and so forth. I found the conversation bizarre.

Sam Cushnahan never paid Tax or VAT, but was never pursued.

Cushnahan said that a senior member of Sinn Fein/Provisional IRA and two loyalist paramilitaries had been involved in the running of one of his brothels on the Falls Road. The senior Sinn Fein/PIRA member was John Joe McGee, who Sam claimed was a British Agent. John Joe McGee would socialize with members of Sinn Fein/PIRA and then invite them to the brothel on the Falls Road. Once the Sinn Fein/PIRA members were recorded in compromising activity, they would be recruited by British Army Intelligence.

This brothel on the Falls road was a regular haunt for Gerry Adams Snr, Freddie Scappitticci, Ruby Davidson and a host of Sinn Fein/PIRA sexual deviants. As a result of the number of Sinn Fein/PIRA deviants recruited in this brothel and others operated by Cushnahan, the security services referred to the Sinn Fein/PIRA Leadership in Belfast as 'The Jocky Club'.

I honestly do not know how many calls I received from Sam Cushnahan begging me to go into FAIT, in the end I relented. I was the only person in the FAIT office, initially I spent my time going through any paper work I could find to establish where the money went and what was owed. I was Lecturing in Business part-time at this point in The Department of Continuing Education at QUB, so I had a good handle on accounts.

It is not unfair to say that a great deal of tax payers’ money (£1,000,000) had been squandered and the debts were insurmountable. As someone who had worked in factories up to 1992, I found this waste of tax payers’ money unforgivable.

As I had no money or resources, I used the only tool available to me, the media. As Sinn Fein/PIRA were hammering me in their own media outlets such as An Phoblacht and through some of their proxies, I hammered back, and this is where it got interesting.

Because people seen me standing up to the terrorists, and the terrorists hitting me hard, some disgruntled people within paramilitary groups began to contact me and provide me with information about planned terrorist attacks, weapons, explosives and so forth. While I had some contacts before 1998, this was a tsunami of information.

Following a high-profile attack on me 18 July 1998 by six members of Sinn Fein/PIRA Mark Sykes, Stephane Long, and so forth led by PIRA killer Sean Clinton, my kudos was boasted by those who sought a safe space to disclose information. One of my attackers pleaded guilty to assault in Court and the threat to kill was taken into consideration. The Sinn Fein/PIRA member who pleaded Guilty to assaulting me was accompanied to Court by Jock Davidson and others with whom a few months earlier I had been sharing a pot of tea.

I can say with confidence that some of this information, and the related action by the RUC, saved the peace process and the Good Friday Agreement and that is why I shared a public platform in The Ulster Hall and thanked the RUC in 1999. In fairness to those attacking me, they did not know that they owed their lives to the RUC and that includes senior Sinn Fein/PIRA and others who would jump in front of cameras to try and discredit me, not knowing that my work had saved them and their families.

The suspicions highlighted by my Garda contact that FAIT was being used by extreme loyalist elements connected with Sam Cushnahan, who were not only trying to undermine the peace process but also running black propaganda against PUP/UDP were well founded.

Plans by some to plant no-warning bombs in Dublin and Monaghan once again 1998-99, were prevented by the information I gleamed from my time in FAIT and later Northern Ireland Human Rights Bureau which I set-up purely to maintain contact with valuable informants, it was essential that the ‘intelligence’ aspect of my work was removed from FAIT or many people could have died. I can prove all of this.

When the LVF/Orange Volunteers murdered Solicitor, Rosemary Nelson, Sam Cushnahan wanted me to issue an outrageous press release, which suggested that some markings that Rosemary Nelson had on her face, throughout her life, were the result of a bomb she was making some years earlier exploding prematurely. While I was trying to maintain my intelligence role, I refused outright to issue such a press release.

Over the few months that I managed to tolerate Sam Cushnahan, I gleamed a great deal of information about his personal life and criminal activity, in which I had no particular interest.

Sam had been involved in Kincora Boys home, that involvement began when he was laying down carpet in the home, he spoke to me openly about all of this, as if I were someone who would tolerate such criminality. Sam Cushnahan stated that his helper at Kincora, also from the lower Falls was Gerry Adams Snr, and both of them had sexually abused children in Kincora, although he did not use the word ‘abused’.

Sam told me that he had been in the merchant navy, and when he ‘retired’ from that he was involved in criminality with James Craig, although he told this as if it was nothing, as if he was Arthur Daly out of Minder, wheeler and dealer. He had been involved in break-ins, stolen property and acted as a fence. He also said he was caught red-handed, when he burned a building to get the insurance, but again he knew the right people, again this Mantra about the ‘right people’ came up time and again.

Sam Cushnahan told me that he had begun his career in the brothel business with a Pimp called Bernie Silvers and later Sam was in a sexual relationship with a Mr Francis with whom he operated a Brothel on Stranmillis Road in Belfast. The women and girls in these Brothels were referred to by Sam as his ‘Girls’ and they in turn referred to him as ‘Sammy’, a well know female in Northern Ireland was the Madame in his Brothels before she reinvented herself.

Interestingly, Monica McWilliams of The Northern Ireland Women's Coalition sought a meeting with Sam and I, I had no interest in meeting McWilliams as I viewed her as a "Powder-Puff Provo". Sam and I meet with McWilliams at her office in Stormont, a good friend of mine Kate Ferron, whom I knew from QUB showed us into McWilliam's office. Monica McWilliams welcomed Sam with an embrace and referred to him as "Sammy".

Monica McWilliams became fixated on me once I walked away from FAIT and Sam Cushnahan, I had to report Monica McWilliams to the PSNI for Stalking me on Social Media in 2023.

When I closed FAIT, Sam realised he had said too much and he and the Madame set about trying to discredit me, as they had done to Nancy Gracey, Glynn Roberts, and others over the history of FAIT. It is worth noting, that Spotlight, BBC NI, only set about trying to discredit me when I left FAIT and parted company with Sam Cushnahan, before this, when I was in FAIT, BBC NI supported my work.

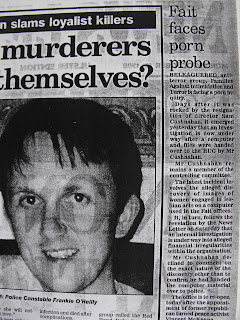

In this Newsletter article, Sam Cushnahan claims that porn had been found on the FAIT computer after Glynn Roberts had left FAIT in order to discredit Glynn. In fact it was Sam who had planted to the porn to discredit Glynn. Glynn had done no wrong. In 2000, Susan McKay would claim in an article in The Sunday Tribune that porn had been found on the FAIT computer while I was there, however, Susan McKay knew well the porn referred to was found long before I went near FAIT, McKay, a liar and fraudster, now the Press Ombudsman in The Republic.

However, I had no interest in them or their sordid life style, I was interested in preventing murder and saving the peace process and I can easily prove that I done this.

Sam Cushnahan constantly talked about knowing the right people, yet, any RUC Officer that I spoke to wanted nothing to do with him, it was as if there was something in the background that I did not know about, the main objective was achieved, and then I spoke to The NIO, Billy Stevenson, to ensure no further funding for FAIT, I closed it down, and I continued to work on a voluntary basis nurturing and maintaining new intelligence assets within The Northern Ireland Human Rights Bureau.

While I was in prison in The Republic, I received letters from a journalist called Frank Doherty, whom I did not know. In the letters Frank said that he had seen ‘The Bank Statement’ relating to a £2,000 payment made to FAIT by RUC Informer, Martin McGartland. When I was released from Prison, I meet Frank Doherty in Drogheda, my only interest was to establish where he got McGartland’s details.

Frank Doherty told me that Sam Cushnahan had given him McGartland’s details prior to McGartland being shot as Sam wanted to be at the centre of a book that Frank was writing about various matters relating to Northern Ireland.

I am aware that McGartland issued a press release after he was shot claiming that I was an active PIRA Intelligence Officer, this press release shown to me by Mr Hugh Jordan of The Sunday World. On the basis of McGartland’s lies, I was questioned at Castlereagh RUC station for several hours.

I can say with certainty, it was Sam Cushnahan who not only leaked McGartland’s details, but got paid for such leaking. I believe it was Sam Cushnahan who set-up McGartland, and was able to do so because of McGartland’s passing his own information by way of a bank statement. I have supporting evidence that Sam Cushnahan had previously sent a come-on letter to British Army Captain, Fred Holroyd, who served with MI6 in Northern Ireland in the 1970s. The letter was to lure Holroyd to an address in Belfast. Holroyd was to be murdered by loyalists, and the blame placed on The PIRA.

Conclusion

In conclusion, it is not unfair to say, that nobody could have envisaged the amount of Intelligence that I would gain from entering FAIT and later creating The Northern Ireland Human Rights Bureau. Scores of lives were saved, bomb attacks prevented, and the fledgling peace process got a chance to deliver, in my view it did not deliver, and my explanation for this determination can be viewed in the Omagh Bomb Blog Post.

Personal Political Background

This submission and factual history has been prepared by Vincent McKenna BSSc PGDipSSc MSc. Certified Digital Marketing Professional.

My Paternal family history can be traced directly to McKenna Clan Chieftain, Patrick McKenna, who sat at The Hill Of Tara in County Meath in the seventeenth century. Patrick's son Niall McKenna would in 1641 slaughter over 2,000 Protestants in the Northern counties. Plans by the British to retaliate for this slaughter was delayed by the English Civil War, however, Oliver Cromwell administered that retaliation in 1648.

My Great Aunt Kathleen McKenna, was in 1921, Private Secretary to Sinn Fein Leaders Arthur Griffith and IRA Leader, Michael Collins. Kathleen died in 1988, and I was able to speak with Kathleen on her return to Ireland and before her death. My loyalty has been to The Irish Republic created by my Great Aunt Kathleen. Kathleen was non-sectarian and viewed Provisional IRA/Sinn Fein as sectarian bigots.

Kathleen McKenna travelling to London with Sinn Fein Leader, Arthur Griffith to sign the Treaty.

Between 1982-84, I was introduced to and meet with on a number of occasions, Sean McBride SC who had been Chief of Staff IRA, 1936-37. I had been introduced to Sean McBride SC at The four Courts by Paul Callan SC who was representing me in an extradition case. Sean McBride SC had a domestic and international political reputation and would be awarded the Nobel Peace Prize.

Sean McBride SC who had been anti-Treaty in 1921, was of the same mind as my Aunt Kathleen McKenna in the 1980s, Provisional IRA/Sinn Fein were sectarian bigots.

I was sworn into The Provisional IRA in 1980 when I was 16-years-old by my cousin, Kevin McKenna (PIRA Chief of Staff, 1983-1997). I would be Kevin McKenna's eyes and ears within Sinn Fein/Provisional IRA in Monaghan Town. Kevin McKenna lived in Smithborough, County Monaghan.

As members of Sinn Fein/Provisional IRA talked-out-of-shop to me they would not have known how close I was to Kevin McKenna.

I am far left in this picture with John Hume MEP right 1994. I was working with John Hume from 1992 and created early drafts of what would be come known as The Good Friday Agreement. Between 1996-98, I worked on the final draft of The Good Friday Agreement.

I stepped away from the Good Friday Agreement when Kevin McKenna and Martin McGuinness admitted to me that they were arming The Real IRA to use as Proxies, this duplicity, had been used by Sinn Fein/Provisional IRA many times before.

Republican Action Force was the name used by The Provisional IRA when they murdered 10 innocent Protestants in Kingsmill in 1976, I know this because my cousin Sean McKenna was one of the gunmen, and I spent many months with Sean as he recorded his life story.

Direct Action Against Drugs was set-up by the Sinn Fein/PIRA Leadership in Belfast to take protection money from drug dealers. I know this, as Jock Davidson was my main Provisional IRA contact in the Markets/Shortstrand/Lower Ormeau Road area in Belfast for a number of years in the 1990s.

Kevin McKenna had been known to me from the time I was a small child, when Kevin would cycle into Aughnacloy and Kevin would take me on the crossbar of his bike to my grandparents house in Coronation Park.

In 1981, I had graduated from Na Fianna Eireann to working on Internal Security with JB O'Hagan, the PIRA member in uniform front left was dismissed from The PIRA because of my evidence to The PIRA Command Staff. For example, this PIRA member told me about certain matters that placed men and equipment at risk.

Caoimhghín Ó Caoláin TD swore me into Sinn Fein/PIRA at a meeting attended by JB O'Hagan, Kieran Starr's and Padraigin Ui Mhurchadha (sister of Fergal O'Hanlon, shot dead 1957). I do not think that Caoimhghín Ó Caoláin ever knew that I was close to Kevin McKenna.

In this picture Caoimhghín Ó Caoláin beneath the black flag with pick-axe handle raised above his head as protesters attack Gardai during a Hunger-strike march in Dublin in 1981. Before we left Monaghan that morning members of Sinn Fein/PIRA purchased dozens of Pick-axe handles from Patton's Hardware store in Monaghan Town to attack Gardai. It was hoped we would reach the British Embassy and burn it to the ground as was done following Bloody-Sunday. In this picture, Omagh Bomber, Seamus McKenna (black leather jacket) can be seen calling up those with the petrol bombs, to try and breach Garda lines.

I am in the picture below 1981 on the left carrying a symbolic coffin in Monaghan Town to commemorate the death of PIRA Hunger-striker, Kieran Doherty TD. We are all in-step to commands being shouted in Gaelic, I had learnt these commands in Na Fianna Eireann. This picture was reproduced in An Phoblacht in 2013 for a National Hunger-strike commemoration. In 2013, I was back on the inside of Sinn Fein/PIRA in Dublin and helping to develop their Information Technology systems.

My main contact 2013-2015 was Bobby Storey, I parted company with Bobby again when he admitted the Provisional IRA Army Council including Bobby had sanctioned the murder of Kevin McGuigan in Belfast.

I am encircled in the picture below behind to the left of John 'Dinger' Bell, I and others were to open a corridor through the crowd to get the PIRA gunmen up an entry and into the back of a house previously rented by one of the gunmen.

The weapons and uniforms were to be moved in two Hi-ace Vans, one driven by Malachy Toal and the other by Patrick McKenna. Garda officers tried to block the exist of the two vans and the Garda car was over-turned into a ditch.

Garda Detective, Joe Derwin opened fire with an Uzi-sub-machine gun and later a revolver. With their backs to the camera are PIRA Laurence McKenna (sentenced to 5-years for this incident) and Laurence McNally (shot dead by SAS 1991). Laurence McNally, Laurence McKenna and I confronted Joe Derwin, in order to prevent mourners being shot.

Two of the PIRA gunmen, Cathal and John would not be known as PIRA outside Sinn Fein/PIRA. The OC, facing the camera, John 'Dinger' Bell.

The Plan to Murder Gerry Adams

Background

From the outset of the sectarian conflict in Northern Ireland, be that The IRA Border Campaign 1957-62 or the retraining and restructuring of The IRA 1962-66, there were constant efforts made by both the British and Irish Governments to maintain ‘peace’ within a Law and Order rather than a Social Reform framework.

It is clear from the evidence of State papers released in The Irish Republic that the IRA was ready and preparing for a fresh campaign of sectarian violence. My own knowledge of this IRA preparedness in the 1960s, is boosted by my association with 1960s IRA men, Ruairí Ó Brádaigh, Joe Cahill, JB O’Hagan, Vincent Conlon and so forth in the 1980s, when they were leading The Provisional IRA.

While it is often stated that the sectarian conflict in Northern Ireland began for real with a Civil Rights March in Derry in October, 1968, a march baton charged by the RUC. This Civil Rights March followed by the creation of The People’s Democracy at Queens University, Belfast by Bernadette McAliskey (nee, Devlin), this is not the case.

In the summer of 1968, while I was 5-years-old, a paternal relative of mine, who was living in Caledon, County Tyrone, assisted nationalist politician, Austin Currie, and two members of the IRA Patsy Gildernew and Joe Campbell to break into and squat in a vacant house.

Left to Right: Patsy Gildernew, Austin Currie and Joe Campbell

This in protest at the allocation of the house to a single Protestant woman and not to Patsy Gildernew and his family. In the 1980s Joe Campbell was living in Monaghan Town and sharing a house with PIRA Army Council member, JB O’Hagan.

Joe Campbell, said, “While the local council provided the opportunity in 1968, we in The IRA exploited that opportunity”

Joe Campbell in front of man with child at IRA march in Monaghan Town, 1981.

This allocation process, appeared to favor Protestants over Catholics, particularly when individuals could be identified as having connections with Unionist Politicians. However, in Monaghan Town, in 1982, I was married with one child, and a Fianna Fail Councilor, Edmund Burke told me I could have one of the new council houses on Cortolvin Road, if I would vote for Fianna Fail in the election that year. I declined the offer, and was eventually granted a house in the less sought after, Mullaghmatt Council Housing estate in Monaghan.

I can also say that many hundreds of my paternal, and to a lesser degree, maternal families, moved from The Irish Republic to Northern Ireland in the 1950s/60s to enjoy the benefits of council houses that had electricity, running water and a sewerage system, while a few hundred yards away in north Monaghan, families lived without what where being described in Northern Ireland as basic Civil Rights.

The point I make above, from real life experience, is that political allocation of houses and jobs, was not exclusive to Northern Ireland, and social depravation and disenfranchisement was much more common in The Irish Republic.

Hensey McKenna Death

In the 1960s it would have been difficult for any Irish Government to demand a certain standard of living and freedoms in Northern Ireland when the same standard of living and freedoms were not available to the majority of people in The Irish Republic.

Dublin, 1968, hundreds of thousands lived in slums, hundreds of thousands disenfranchised.

When Jack Lynch became Taoiseach, 1966, he was given an assessment of The IRA by then Secretary of The Department of Justice, Peter Berry, for Lynch’s first meeting with British Prime Minister, Harold Wilson.

Peter Berry explained to Jack Lynch that up to one-thousand men, women and children were under the command of The IRA Army Council, this was an increase from the estimate of six-hundred-fifty in 1962 when the failed IRA Border Campaign was halted.

Peter Berry further reported that The IRA had been involved in drilling and arms training since its announced cessation in 1962. While The IRA were numerically strong, they lacked the finances for any sustained campaign of violence and Peter Berry was also aware of Communist leanings by some of The IRA leadership.

Peter Berry concluded in his assessment of The IRA, that, any number of sparks could be used by The IRA to light a fresh campaign of sectarian violence.

When the sectarian conflict began for real, there were many efforts by many stake-holders to end the violence. In my own estimation, the British Foreign Office through MI6 were in contact with The Provisional IRA Army Council from the outset.

The British Government also used the British Embassy in Dublin to built a relationship with the Irish Government, with varying degrees of success.

I do not support the view of many, that MI5, RUC Special Branch, British Military Intelligence and The NIO were opposed to any dealings with The Provisional IRA. All of these stake-holders were simply more cautious in their dealings with Sinn Fein/Provisional IRA as they knew them on the coal-face, not from behind a desk in Whitehall.

All of that said, there remains key question marks over the role of MI6 Officer, Michael Oatley and his dealings with Martin McGuinness. The complexity of this relationship, is captured in the 1993 Communication from Oatley to McGuinness.

In the 1993 Communication from MI6 Officer, Michael Oatley to Martin McGuinness, Oatley signs off with: (see, Exhibit 1).

“I hope you will not mind me ending with a new meaning to Tiocfaidh ár lá (Our Day will Come).”

NOTE: This Communication was initially hand-written by Michael Oatley and addressed to Martin McGuinness. However, Officer, Robert (see, initial) typed up the Communication in order to remove Martin McGuinness’s name from the top of the document and Michael Oatley’s from the bottom. Surely, if McGuinness was acting on behalf of Sinn Fein/Provisional IRA there should have been no fear of disclosure.

Robert was an MI5 Officer who meet with Martin McGuinness and Gerry Kelly MLA within days of the 20 March, 1993, Warrington Bomb attack in England in which two children were murdered. It was at this meeting that Robert gave Martin McGuinness the Communication from MI6 Officer, Michael Oatley, however, Gerry Kelly MLA was not made aware of this Communication by either Robert or McGuinness.

Communication, 1993, from MI6 Officer, Michael Oatley, to MI6 Agent, Martin McGuinness.

It was this 20 March, 1993 indiscriminate litter-bin bombing in Warrington that certain loyalists hoped to replicate in Dublin and Monaghan in 1998, however, I was lucky to be in a position to prevent the bomb attacks in Dublin and Monaghan.

Tiocfaidh ár lá in Sinn Fein/Provisional IRA parlance means a continued armed campaign until such time as a United Ireland free from British interference is achieved.

So, what is the “new meaning” that MI6 Officer Oatley is referring to? The surrender of The Provisional IRA, the removal of The Irish Republic’s claim over Northern Ireland, as then contained, in Articles 2 and 3 of Bunreacht na hEireann (Irish Constitution) and an acknowledgment by Sinn Fein/Provisional IRA that Northern Ireland is an integral part of The United Kingdom by Sinn Fein/Provisional IRA administering British Rule from Stormont.

This Counter-Republic, achieved by Agents of Influence, is certainly a desirable out-come for the British.

Whatever, the “new meaning” alluded to by Oatley, it is clear that the relationship between Oatley and McGuinness was not one of McGuinness being a negotiator on behalf of Sinn Fein/Provisional IRA and Oatley being a messenger to the British Government.

MI6 Officer, Michael Oatley also profiteered from his relationship with Martin McGuinness and Property Developer, Brendan Duddy. Duddy had claimed that he was the middleman between MI6 and Martin McGuinness, however, it is clear from Oatley’s communication to McGuinness in 1993, that no middleman was required for much of their relationship.

Michael Oatley, Somerset, England, was listed at Companies House as a director of the Strand Hotel/Holiday Inn Express Derry-Londonderry from 2015 until October, 2018. Oatley had built up a substantial business portfolio in Northern Ireland while working with Martin McGuinness and Brendan Duddy.

MI6 attempted to recruit me on two occasions, 1995 in Cambridge and 1999 in London. The 1999 encounter was the most telling, as the MI6 Officers, had no concern about the fact that Kevin McKenna and Martin McGuinness had armed the Real IRA. It would not be unfair to say that MI6 held the same view as Kevin McKenna and Martin McGuinness:

“The odd bomb going off here and there will help keep Unionists focused on working with the ‘Doves’”.

Such a view could easily be understood within a certain set of circumstances, however, can such a view be justified when those bombs deliver mass-murder, intentional or not, as happened in Omagh 15 August, 1998. There is an intrinsic moral culpability and potential for harm as encouragement, for those who would carry out acts of terrorism.

It can certainly be said that in the absence of the full facts in 1998 which lead to the Omagh Bomb, the Omagh Bomb and its aftermath were used as leverage to nudge unionists into power-sharing with Sinn Fein/Provisional IRA.

However, it is my view, from real-time operational experience, that as late as 1999, MI6 knew virtually nothing about the operational capacity of the Real/Continuity IRA, and I am not sure they were too bothered. MI6 offered me money, which would be funneled to me through a Manchester based businessman, and if the money was discovered, the businessman would say he was funding my peace work. I declined the MI6 offer in 1995 in Cambridge and I declined the MI6 offer in 1999 in London.

MI6 told me they had funneled money to Bertie Ahern in exactly the same way. Bertie Ahern, while before The Mahon Tribunal on political corruption many years later, would try and explain away large amounts of Sterling (English money) he received in the 1990s by saying he had won the money on the horses.

MI6 had achieved their objective as directed by The Foreign Office, which was the removal or dilution of Articles 2 and 3 of Bunreacht na hEireann (The Irish Constitution) that laid claim to Northern Ireland. MI6 had secured the agreement of The Irish Government and Sinn Fein/PIRA to that dilution or removal and which was then ratified by Referendum in The Irish Republic.

John Taylor MP who was a key Unionist negotiator at the talks leading to The Good Friday Agreement, said:

"At the talks leading to the Belfast Agreement both the Republic of Ireland Government and Sinn Fein agreed to The Republic of Ireland abandoning its claim over Jurisdiction of Northern Ireland. They therefore agreed to the abandonment of Articles 2 and 3 and recognised Northern Ireland as part of The UK. The people of the Irish Republic agreed in referendum." (Twitter, 17 February, 2023).

From a security point of view the operational capacity of Sinn Fein/PIRA was left to The RUC, MI5 and An Garda Siochana. The London and Dublin Governments were not losing any sleep due to the continued gangland criminality of Sinn Fein/PIRA and Others. Such gangland criminality viewed by both Governments as "Internal House-keeping" and not breaches of their Articles of Surrender.

From my own knowledge of the RUC (and by definition MI5) cooperating with An Garda Siochana, significant numbers of operations that could have completely derailed the 'peace process' were prevented. The only significant departure from this cooperation, was Banbridge and Omagh. This departure explained in this submission.

Banbridge and Omagh Bombs

On 4 July, 1998, I received a phone call from my cousin Seamus McKenna. In 1998, Seamus McKenna was working within a tight circle of Real IRA and Continuity IRA members who were mainly based in County Louth and to be found socialising in the Emerald Bar in Dundalk owned by Colm Murphy.

Seamus McKenna was well known to me since I was a small child. I would as a child visit my Uncle Sean's house in Newry (These visits referenced in Sean McKenna Jnr Biography) with my Father, Grand-father and Great-Grand-Father. During my Uncle Sean's funeral in 1975, I had stayed in my Uncle Sean's house in Newry for his wake.

In later years, when I had moved to Monaghan Town, my cousin Seamus would visit me. Seamus McKenna had extreme loyalty to me, as I had also taken care of his brother, Sean McKenna Jnr (PIRA Hunger-striker, 1980) when Sean was released from Long Kesh (The Maze Prison). Seamus would often talk about his Father, Sean McKenna Snr who had died as a result of the torture he had been subjected to during Internment.

Seamus always wanted me to know that he was still fighting in order to punish the Brits for what they had done to his Father. Seamus always spoke openly to me about what he was doing.

Seamus told me on the 4 July, 1998 that the Real IRA were going to bomb Banbridge and Omagh. I passed over what Seamus said and did not draw too much attention to it, because if Seamus thought I was trying to get information, rather than him giving information, he would simply say “Fuck Off”. I reminded Seamus about a time was I was placed in a cell in Omagh Court House and there was no back wall in the cell as PIRA had blown it up a short time before.

As soon as I finished my phone call with Seamus 4 July, 1998, I immediately phoned a Garda Special Branch Officer, Liam Donnelly, in Monaghan Town, whom I had known for some years. I told Liam Donnelly, what Seamus had said, and he said he would pass it on and get back to me.

Note: Garda Detective, Christy McNamee, known to me from 1980, who had retired, was in the 1990s working as a Private Detective. I had employed Christy as a Private Detective in relation to a number of matters. Garda Detective, Liam Donnelly, while employed by An Garda Siochana was doing freelance work with Christy McNamee, it was Christy who introduced me to Liam Donnelly.

On Monday 6 July, 1998, my Garda contact, Liam Donnelly, phoned me and asked if I would meet with someone from Dublin who wanted a face to face. It just so happened that I had been invited to a function at Áras an Uachtaráin, the home of The Irish President, Mary McAleese, 11 July, 1998. I told my Garda contact Liam Donnelly that I would meet his contact at Áras an Uachtaráin on the 11 July, 1998.

When I arrived at Áras an Uachtaráin on the 11 July, 1998 in the company of three others, who did not know my mission, we were welcomed by Mary McAleese and her husband Martin. Mary McAleese was known to me, as she had attended some of my peace work at Queens University in Belfast, when she was lecturing at QUB and I was a student.

When I received a call on my mobile phone, I excused myself from my company, and went to a side room of the main room where the function was taking place.

NOTE: In 1998, mobile phones were not as widely available as today, however, I had been employed by a Market Research Company called 'High Fliers' (Cambridge) to carryout Graduate Research at Queens University, when my Graduate Research was complete, High Fliers, allowed me to keep the mobile phone they had supplied to me for the Research.

I repeated at Áras an Uachtaráin to a senior Garda Officer what my cousin Seamus McKenna told me about Banbridge and Omagh, and I made it absolutely clear that I wanted Michael McKevitt, Bernadette McKevitt Sands, Seamus McGrane, Liam Campbell, Colm Murphy, Seamus Daly and Seamus McKenna arrested and taken out of circulation.

When I left Áras an Uachtaráin in the early hours of 12 July, 1998, I was satisfied that both the Banbridge and Omagh bombs would be stopped. As we prepared to leave Áras an Uachtaráin in the early hours of 12 July, 1998, a dark shadow had fallen upon us, as we received news that three children had just been burned to death in an apparent sectarian attack in Ballymoney.

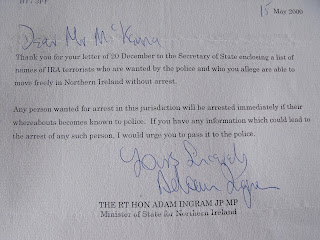

Letter Ref: JDM/dh, dated 30 September, 1998, signed by Solicitor, Jason McCue working for Henry Hepworth, London, to Vincent McKenna.

Faxed again to Vincent McKenna from: Henry Hepworth – 0171-242-7998 on 3 December, 1998.

The letter explains that on dates including, July 14, 1998, I was a significant witness against Provisional IRA Chief of Staff, Thomas ‘Slab’ Murphy. I was a witness as I hoped that exposing the personal fortunes accumulated by Leadership members of Sinn Fein/PIRA would discourage lower ranking Sinn Fein/PIRA members from continuing to support acts of violence in the name of the 'cause’.

Following my disclosures at Aras an Uachtarain, 11 July, 1998, about the Banbridge and Omagh Bombs, I was asked to give sworn testimony in a closed Court setting, in order to prepare for the arrests of the Real IRA Leadership by Warrant. The date for this closed Court clashed with the date for me to give evidence against Thomas ‘Slab’ Murphy.

The Judge presiding at the closed Court hearing wanted an explanation as to why I was absent from the closed Court hearing, but did attend on another day, hence the letter from Jason McCue.

In the end, none of the above mattered as Bertie Ahern Directed the Garda Commissioner, not to arrest the Real IRA Leadership, prior to the Banbridge and Omagh Bombings.

On the 18 July, 1998, I was assaulted in Belfast by six members of Sinn Fein/Provisional IRA led by Provisional IRA killer, Sean Clinton. One Sinn Fein/PIRA member would plead guilty in Court to this assault and the threat to kill was left on the books by agreement with me. The PIRA members had not done their homework, I had just won a Silver Medal in The UK Regional Martial Arts Championship.

A few hours after I was assaulted a Sinn Fein/PIRA gang murdered Andrew Kearney in Belfast, Andrew's alleged crime was that he protected a child from assault at the hands of a local Sinn Fein/PIRA gang leader. Sinn Fein/PIRA continued murdering, mutilating, exiling and raping as Mo Mowlam had assured the Sinn Fein/PIRA Leadership that the RUC would not intervene.

Attacks on Mickey Donnelly (CIRA) in Derry and Kevin McQuillan (IRSP) in Belfast by Sinn Fein/PIRA, would result in Joe O'Neil (CIRA) in Donegal dispatching a no-warning 500lb car bomb to Connolly House in Belfast to wipe-out the Sinn Fein/PIRA leadership, however the bomb was intercepted at the Donegal border, as I had been tipped-off by my cousin Seamus McKenna. Gardai would say that the bomb was on its way to a commercial target, however, this was to prevent retaliatory action by Sinn Fein/PIRA.

Sinn Fein/PIRA did in early 2000 plant a bomb at Republican Sinn Fein Offices in Belfast as Republican Sinn Fein Leader, Ruairi O Bradaigh, was to officially open that office, however, a member of the public discovered the bomb and Sinn Fein/PIRA had to cover their tracks by disposing the bomb themselves. I do not know if Sinn Fein/PIRA ever knew about the bomb dispatched by Joe O'Neil.

When the Banbridge Bomb exploded 1 August, 1998, I phoned Garda Detective, Liam Donnelly, and asked him why Michael McKevitt and the bombers had not been arrested, he had no explanation other than the decision was taken in Dublin. I told him that I might have been better going to the media, and he said, “Jesus don’t do that”.

Following the Banbridge Bomb my cousin Seamus McKenna phoned me again and sounded disturbed about the fact that so many civilians had been injured. Seamus talked about the on-going plan to bomb Omagh, Seamus said that there had been a meeting between Michael McKevitt, Bernadette McKevitt Sands and Irish Government officials before Banbridge.

I am satisfied that the meeting between Irish Government officials and the Real IRA before Banbridge was as a direct result of my meeting at Áras an Uachtaráin 11 July, 1998 and my insistence that the Real IRA Leadership be arrested.

Minister for Justice, John O'Donoghue TD while visiting me in Wheatfield Prison in early 2001, confirmed to me that he and Bertie Ahern had sent Dr Martin Mensergh to meet with The Real IRA following my tip-off, 11 July, 1998. According to John O'Donoghue TD the Government did not want to undermine Gerry Adams and Martin McGuinness by arresting the sister of Bobby Sands, shortly after signing The Good Friday Agreement.

Between 2010-2011, I was close to Bernadette McKevitt-Sands and she confirmed that the meeting between Dr Martin Mensergh and the Real IRA was before Banbridge, and Mansergh had made it clear that the Government knew the Real IRA were planning a fresh bombing campaign.

Bernadette confirmed that in the aftermath of Omagh, Dr Mansergh meet with the Real IRA Leadership again and offered a full-amnesty in relation to Omagh if the Real IRA would disband. The Intel Report below was submitted by me, six-weeks before Paddy Dixon was blown up in Navan in 2011, with a booby-trap bomb.

In 2011, Bernadette McKevitt-Sands, was working in Navan, Paddy Dixon and I, were living in Navan, County Meath.

In the aftermath of the Omagh Bomb, I was able to prevent further Bomb attacks that were being directed by the Leadership of Real/Continuity IRA. My source for this information was Seamus McKenna and specifically related to the 500lb bomb destined for the residence of The Secretary of State in Northern Ireland, Peter Mandelson and the bomb dispatched by Joe O'Neil to bomb Connolly House in west Belfast.

The difference between these two bombs being stopped and the Banbridge and Omagh Bombs being allowed to run, was the fact that I provided the information about the Mandelson and O'Neil bombs to the RUC, not An Garda Siochana. As the Mandelson bombers were being arrested, an RUC officer phoned me and thanked me for providing information that prevented the bombing.

This is an original part of an Intel Report in which I identified the location of one of the bombers. The RUC had absolutely no clue that this individual was a terrorist until I identified him as such.

The London bomb team including Queen's University student, Darren Mulholland, who was known to Seamus McKenna in Dundalk and I at QUB, was also arrested in 1998 based on my information. However, unlike the Banbridge and Omagh bombs, An Garda Siochana shared my information with MI5. At QUB Freshers week in the Autumn of 1998, Sinn Fein/PIRA personnel were again recruiting students for a bombing campaign in England, Sean, Kevin and Mark were named publicly by me as the PIRA recruiters.

BBC Spotlight would later state that I had lied about students being recruited for a bombing campaign in England, even though the student bombers had been arrested with semtex before the program was aired. It may be the case that 'dark forces' and their proxies in the media had wanted the bomb attacks to go ahead, however, my going public had prevented the attacks.

I had also prevented attacks on leading members of Sinn Fein/PIRA in Belfast and bomb attacks in The Irish Republic, these were planned loyalist attacks, however, I cannot at this time name the informants, as one at least is still alive. Gerry Adams and Caoimhghin O'Caolain were only made aware of this aspect of my work in 2018.

In 2019, I meet Bertie Ahern at a function in north Dublin, and Bertie Ahern confirmed that he had directed Garda Commissioner, Pat Byrne, not to arrest the Real IRA Leadership prior to the Banbridge and Omagh Bombs, as he was taking his direction about the Real IRA from Phil Flynn, Gerry Adams, Martin McGuinness and Caoimhghin O'Caolain.

Bertie Ahern with PIRA Army Council members, Gerry Adams, Martin McGuinness and Martin Ferris.

Bertie had chosen to send Dr Martin Mensergh to talk to the Real IRA. Bertie said that Phil Flynn, Gerry Adams, Martin McGuinness and Caoimhghin O'Caolain, described Bernadette-McKevitt-Sands in particular, as republican royalty, and her arrest with her husband Michael McKevitt could undermine Adams and McGuinness on their home ground where there was strong opposition to The Good Friday Agreement. This opposition, manifested in brutal attacks by Sinn Fein/PIRA on Kevin McQuillan in Belfast and Mickey Donnelly in Derry City.

Seamus McKenna said the Court House in Omagh was going to be bombed on Saturday the 15 of August, 1998, he was not happy about it, but what could he do.

I phoned Garda Detective, Liam Donnelly in Monaghan and updated him on what Seamus had said about the plan to bomb Omagh Court House on the 15 August, 1998. Garda Detective Liam Donnelly assured me that the bomb would be stopped and to say nothing to anyone else. I made a note in my 1998 diary, this diary has been seen by senior police officers. I have been a prolific diarist from 1980.

On Saturday 15 August, 1998, I was in Portrush in a mobile home and listening to the radio expecting to hear that the bomb had been stopped on its way to Omagh, when news of the bomb exploding came on the radio, it put me to my knees. I could not believe that the bomb had not been intercepted. I phoned Garda Detective Liam Donnelly, he had no explanation other than the decision was taken in Dublin, and he sounded like he was under pressure.I then phoned renowned journalist Barrie Penrose with whom I was working on the, Thomas 'Slab' Murphy case, at that time and I put on record with Barrie everything that had happened over the previous weeks including the names I had given to the Irish authorities.

I also got a bus to Belfast, left my partner and children in Portrush, and briefed a couple of trusted journalists as I believed the truth about Omagh would never be told.

The Omagh Bomb became very personal for me, when it became clear that Avril Monaghan, Avril's mother, Mary, Avril's little daughter Maura and Avril's unborn twins were all murdered. Avril's husband Michael and his brother Dermot were school friends of mine, we had played GAA together at St Ciaran's Secondary school in Ballygawley and in our local clubs of Aughaloo and Augher.

My cousins Willie, Eugene and Dessie McKenna had a small pub in Augher close to Monaghan's pub and I had played darts in both bars many times over many years, this was a small rural community ripped apart in Omagh on the 15 August, 1998.

In 1998, in the immediate aftermath of the Omagh Bomb when I publicly criticised Bertie Ahern and John O’Donoghue for directing Garda Commissioner, Pat Byrne, not to arrest the Omagh Bombers pre-Omagh, both Ahern and O’Donoghue stated publicly that they could not direct the Garda Commissioner in his operational duties.

Unfortunately, by the time of the Omagh Bomb investigative journalism had all but died alongside the truth, nobody would investigate my claims, all of which have since been proven true.

In 1970, the head of Garda Special Branch had pleaded with Jack Lynch, not to order him to arrest the PIRA Army Council who were meeting in Cavan, the head of Garda Special Branch had told Jack Lynch that An Garda Siochana had agents at the table. Jack Lynch had in 1979 directed the Garda Commissioner of the day not to investigate Narrow Water, when 19 British soldiers had been murdered following sanction from Martin McGuinness.

It was this action by Lynch in 1979, that led certain Garda officers in Monaghan Town to form a coherent intelligence unit that would work closely with other agencies to exchange information on the Provisional IRA.

In 2021, former Minister for Justice in The Irish Republic, Michael McDowell SC would tell publicly how Bertie Ahern’s Government did in 2002 grant a De Facto Amnesty to Sinn Fein/Provisional IRA murderers. McDowell stated that Bertie Ahern’s Government directed the Garda Commissioner to focus Garda resources against the Real IRA, Continuity IRA and hands off the Provisional IRA.

In February 1999, it was clear that there was nobody in The Irish Government interested in establishing the truth about the Omagh Bomb, and in order to place pressure on my Garda contacts, I used a public platform to name Michael McKevitt as the Leader of the Real IRA and responsible for the Omagh Bomb.

Many in the world of politics and media, used the excuse, that naming suspects could prejudice future trials, however, this was a convenient lie, as such trials would take place before professional judges and not a jury. The same reluctant commentators had no problem naming suspects in the past, however, this time it was different, the bombers had been sitting with Gerry Adams and Martin McGuinness only months earlier.

BBC NI Spotlight had in 1999, critiqued my public naming of the Omagh Bombers, and yet, BBC NI Spotlight would later name the bombers, however, such naming, including that of Colm Murphy was rejected by The Special Criminal Court as a reason why Colm Murphy would not get a fair trial.

Immediately following my public disclosure An Garda Siochana, in the form of my Garda contacts, including Liam Donnelly, arrested Colm Murphy. However, while Colm Murphy would be charged in relation to the Omagh Bomb, he would be eventually acquitted as Liam Donnelly had tampered with Colm Murphy's statements. Bizarrely, the tampering exposed by a Garda Forensic expert.

Newly Discovered Facts

Declassified files in Northern Ireland in 2021, show that just months before the Omagh Bombing by the Real IRA in 1998, Sinn Féin/Provisional IRA privately played down the threat from dissident republicans and chided the British Government for how seriously they were being taken.

These declassified files show that the Sinn Fein/Provisional IRA Leadership were advising the British Government through various channels, including MI6, that the Real IRA posed no serious threat. The Sinn Fein/Provisional IRA Leadership were also advising the Irish Government that no action should be taken against the Real IRA.

State Papers released in December, 2021, show that, Taoiseach Bertie Ahern told British Prime Minister Tony Blair only two weeks before the Omagh bombing on 15 August, 1998 that while the breakaway Real IRA had attracted hard core members it did not seem to be “overly active”.

This at a time Bertie Ahern knows the Real IRA are preparing a fresh bombing campaign. If Bertie Ahern believed, as he told Blair, that the Real IRA posed no serious threat, why did Ahern send Dr Martin Mansergh to talk with the Real IRA pre-Banbridge and Omagh Bomb.

In a telephone conversation between the two leaders on July 31, 1998, the day before Bandbridge Bomb exploded, Ahern shared intelligence on the new paramilitary group, composed of former Provisional IRA members who opposed the ceasefire and the peace process.

“Our security people, like yours, I think overstate the position,” he said. “Even when we check it out [the Real IRA] obviously have somewhere close to a hundred people.

“The quality of them I think are probably good enough in that they have an awful lot of the wrong people from our point of view. But they don’t seem to be overly active.”

He added: “Now there is a hard core that of course never stops, never has stopped, and they never will…as long as it doesn’t numerically get too big it means we can keep a good eye on it.

“There is always the worry that somewhere along the way somebody slips you but I think our guys feel fairly happy that they know they’re keeping a handle on it,” he told Mr Blair, who replied “Yeah, I see.”

In the above statement, Bertie Ahern shows his hand, "somebody slips you", this the day before the Banbridge bomb explodes injuring dozens of men, women and children.

A little over a fortnight later, on August 15, a car bombing carried out in Omagh, Co Tyrone, by the Real IRA killed 29 people, one of them a woman pregnant with twins, and injured 220.

The transcript of the conversation between the two leaders is contained in confidential records from 1991 to 1998 held by the Department of An Taoiseach which have now been transferred to the National Archive for public viewing.

Conspiracy to Silence

November, 2002, Bertie Ahern Lied to Dail Eireann about his pre-Omagh Bomb knowledge of the Real IRA Bombers. Dr Martin Mensergh, Bertie Ahern’s key-advisor on Northern Ireland affairs had meet with The Real IRA both pre-Omagh Bomb and post-Omagh Bomb.

We now know, McDowell SC (2021), that as Bertie Ahern was lying to Dail Eireann about his pre-knowledge of the Omagh Bombers, he has granted a De Facto Amnesty to Martin McGuinness, Kevin McKenna and others who were culpable in the Omagh Bombing.

9 December, 2002, I, as a Common Informer (Common Law Term) issued criminals proceedings against Minister for Justice, John O’Donoghue TD on 9 December, 2002, stating that John O’Donoghue TD by his actions had Perverted the Course of Justice in DPP v Vincent McKenna. Documents released to me under a Freedom of Information request, proved that O'Donoghue had given direction to The DPP, James Hamilton.

This intervention by O'Donoghue was at all times about burying the truth about Omagh, as the intervention is made at a time that O'Donoghue's Department was lobbying on behalf of some of Ireland's most prolific sex offenders including serial child-rapist Patrick Naughton.

10 December, 2002: Detective Superintendent, Tadgh Foley, of Monaghan Garda Station, did seek and was granted a Section 42 Warrant for my arrest from Wheatfield Prison, accusing me in relation to the Omagh Bomb. I had prior knowledge of my arrest and I was warned to keep my mouth shut.

One of the Garda Detectives involved in this bogus arrest, told me that I could thank John O’Donoghue TD for the outing.

Following my release from Garda custody back into prison custody, I was on a second occasion taken from custody under a Section 42 Warrant in 2003 and simply warned to keep my mouth shut about the Omagh Bomb. Many years later I would learn that no Warrant existed for this second arrest from Wheatfield Prison in 2003, it was in fact a kidnapping by rogue Gardai.

This second arrest took place after I had Notified, Garda Special Branch in Dublin, in April, 2003, that my cousin Seamus McKenna was making a “Big Mix” (Bomb). I did not deliver this message personally.

I asked a senior prison officer to deliver my message to Special Branch. I done this for two reasons, the first was to ensure that I had an independent witness and secondly, to show prison management that I was not the devil being portrayed in the media by pedophile journalists such as Tom Humphrey's and Patrick 'Paddy' Tierney, just to name two.

This media commentary pre-charge, post-charge and during the trial by Sinn Fein/PIRA proxies went unchallenged by the Courts. On Sunday, January 23, 2000, pre-trial, Anne Cadwallader (married to PIRA convicted Terrorist and protected pedophile, Gerry O'Hare), penned a three-page article about me in a Dublin based newspaper, Ireland on Sunday, the article began on the front page ‘Inside the world of Vincent McKenna’ and was continued in a double-page spread on pages 10 and 11.

According to Ireland on Sunday (March 12, 2000) the paper was enjoying a Readership each Sunday of 197,000 this total not including other media coverage of the paper’s lead stories.

High Court Judge, Mella Carroll, who was one of the three Appeal Court Judges in DDP v Vincent McKenna, having been shown a Sunday Tribune article written by Susan McKay, said: "This case (DPP v Vincent McKenna) was difficult enough for everyone involved, without journalists manufacturing lies around the case, Susan McKay, certainly manufactured the depraved lie about Porn and FAIT, this is worthy of contempt proceedings".

As part of the Black-propaganda campaign being waged against me by Sinn Fein/PIRA proxies in the media, Susan McKay had stated that porn had been found on a computer while I was in Families Against Intimidation and Terror and the RUC had failed to act. In fact, no such porn had ever been found while I was in FAIT.

Months before I had entered FAIT, Sam Cushnahan who was engaged in a personal war with former FAIT Development Officer, Glynn Roberts had told the tabloid media that porn had been found on a FAIT computer in order to discredit Glynn.

Seamus McKenna was, following this tip-off by me in 2003 and subsequent Garda surveillance, arrested in possession of the largest quantity of explosives ever found in The Irish Republic in June 2003. Seamus McKenna was sentenced to 6-years, as this was Seamus McKenna’s first terrorist conviction.

The fact that I had proven again in 2003, that I had information from my cousin Seamus McKenna, gave credibility to my assertions that I had pre-warned An Garda Siochana and the Irish Government about the Real IRA plan to bomb Banbridge and Omagh in 1998.

October, 2003, Bertie Ahern would admit to the Dail, that he misled the Dail in 2002 over Omagh. I had provided information, that proved that Bertie Ahern was a liar about his pre-knowledge of Omagh.

Former, Minister for Justice, Michael McDowell SC, 2022.

Garda Commissioner, Pat Byrne, Easter Bank Holiday 2022, Fairy House Race Course, Irish Grand National.

Reasons Why The Omagh Bomb was Allowed to Run

Before I had the opportunity to speak with the majority of key-players involved in the Omagh Bomb attack, 15 August, 1998, there were three reasons being offered by many commentators as to why the Omagh Bomb was allowed to go ahead, if advanced warning had been given. I set them out here simpliciter:

1. To protect an Agent who was being embedded into The Real IRA in 1998. David Rupert was an FBI/MI5 Agent and was paid $10,000,000 for infiltrating The Real IRA.

Sean O’Driscoll has written a book, The Accidental Spy, about David Rupert’s infiltration of both Continuity IRA and later The Real IRA. I have not read the book, but I have read a pre-view of the book published in The Belfast Telegraph, 12 January, 2019, and in that pre-view, there is an interesting passage:

“After the Omagh Bomb in 1998, his mission became all the more urgent. By now, the FBI had contacted MI5, who needed someone in the larger and deadlier Real IRA”.

This passage if taken at face value, could rule out the Omagh Bomb being allowed to run to facilitate Rupert’s infiltration of The Real IRA.

On 22 March, 2023, at 11.15pm, I watched an interview with David Rupert and his wife, on BBC NI Spotlight. Rupert's association with Joe O'Neil (Continuity IRA) in Donegal from 1992 to 1999, is explained in simple terms. The simplicity of this dangerous liaison is understood by me, as my cousin Seamus McKenna (Continuity IRA) was a guest of Joe O'Neil's in Donegal on many occasions.

David Rupert explained in his own words that he did not meet Michael McKevitt until August/September, 1999, this long after the Omagh Bomb. David Rupert also stated that he had absolutely no prior knowledge of the Omagh Bombing during his association with Joe O'Neil and Continuity IRA.

This admission by David Rupert means that Bertie Ahern and his Advisor, Dr Martin Mansergh were in direct contact with the Real IRA including Michael McKevitt for over one-year before David Rupert meet with Michael McKevitt. In the Spotlight program Dr Martin Mansergh's contribution is limited to his admission that it was Michael McKevitt he meet with and not 32 County Sovereignty Committee as stated by Bertie Ahern to Dail Eireann.

David Rupert explained that in October, 2000, when the FBI had asked David to give evidence in Court against Michael McKevitt, his MI5 Handlers did not want McKevitt arrested. However, the FBI gather evidence for prosecution while MI5 gather intelligence for monitoring terrorists, so nothing significant turns on the attitude of MI5, particularly when we remember that McKevitt could have been convicted on the belief evidence of a Garda Supt pre-Omagh and easily sentenced to 5-years.

March, 2001, Michael McKevitt was arrested by An Garda Siochana and charged with Directing Terrorism. A Garda Detective, who arrested McKevitt in 2001, told the BBC Spotlight program, that McKevitt said to him:

"This is a done deal, I am going to be imprisoned because of who I am".

The Garda Detective went on to say that McKevitt believed himself to be a victim of a political conspiracy by the Dublin Government. While I have no doubt that An Garda Siochana were acting in good faith by arresting McKevitt in 2001, there is no question in my mind that McKevitt's arrest and imprisonment was a political-stunt to try and cover-up the fact that the Omagh Bombers could have been arrested pre-Omagh if it had not been for the unlawful interjection of Bertie Ahern and John O'Donoghue.

Paddy Dixon and his Garda Handler, Garda Sargent, John White, would, following the Omagh Bombing, claim that they had given advance warning to senior Garda Officers about the bombing. These claims by Garda Sargent, John White were accepted by The Police Ombudsman of Northern Ireland.

2. To undermine the Sinn Fein/PIRA Leadership as the majority of ordinary citizens and international observers would not be able to morally distinguish between Sinn Fein/PIRA and The Real IRA.

3. To use the Real IRA bombing campaign as leverage to force Unionists into a power-sharing Executive with the Sinn Fein/PIRA ‘Doves’, this was certainly the view expressed to me by Kevin McKenna and Martin McGuinness pre-Omagh and these were the people advising Bertie Ahern and the British Government through various channels.

Now in 2023, with the announcement by the British Government of a Public Inquiry into the Omagh Bomb and having had an opportunity over 25 years to speak with many of the key players relating to the Omagh Bomb, the reason why the Omagh Bomb was allowed to go ahead can be summarised as follows:

A. The Sinn Fein/Provisional IRA Leadership by arming, by inaction or design, the Real IRA, believed that they could use the Real IRA (Hawks) as Proxies. To bomb Unionists into power-sharing, while Sinn Fein/PIRA presented themselves as the Peace Doves. Unionists could work with the Doves or face the Hawks.

B. The Real/Continuity IRA led by Michael McKevitt, believed that their continued campaign of violence would undermine Gerry Adams and his Peace Strategy. This campaign more personal than political. McKevitt never really understanding that he was simply copper-fastening The Good Friday Agreement.

C. Bertie Ahern and by extension John O’Donoghue, taking advice from Phil Flynn, Gerry Adams, Martin McGuinness and Caoimhghín Ó Caoláin (First Sinn Fein TD elected 1997), did not want to undermine Gerry Adams, Martin McGuinness or the peace process by arresting ‘republican royalty’ Bernadette McKevitt-Sands (Sister of PIRA Hunger-striker, Bobby Sands) and her husband, Michael McKevitt, whom a few months earlier was The Provisional IRA Quarter Master General and sitting on The PIRA Army Council with Gerry Adams and Martin McGuinness.

The third option is the easiest to sustain, and is the option that is easily supported by the evidence.

The third option is the easiest to sustain, and is the option that is easily supported by the evidence. Bertie Ahern was in 1998 already at the centre of a Political Corruption Scandal that would be proven many years later by The Mahon Tribunal. However, as early as 1997, Bertie Ahern’s mentor, Charles Haughey had been exposed, it was only a matter of time before Bertie Ahern walked to the political gallows, and only the distraction of Northern Ireland could delay that public hanging.

NOTE: In July, 1997, Charles Haughey gave evidence to the McCracken Tribunal on corruption confirming that he had received IR£1.3 million (€1.7 million) in gifts from businessman Ben Dunne, which he had previously denied. This damaged Haughey's reputation beyond repair.

Bertie Ahern needed the cloak of delivering 'peace' in Northern Ireland to regain some political value within Fianna Fail and the population in general. Bertie Ahern was not going to do anything that could under-mine Gerry Adams, Martin McGuinness and by association the peace process.

Bertie Ahern was taking his advice about Northern Ireland from former Sinn Fein/Provisional IRA Vice-President, Phil Flynn. Phil had resigned as Vice-President of Sinn Fein/PIRA at the Sinn Fein/PIRA, Ard Fheis in 1984, but as he delivered his resignation speech at the Ard Fheis he swore publicly, in blood, to always remain available to Sinn Fein/PIRA. Phil Flynn would be named as being key to the money-laundering operation that followed the Northern Bank Robbery in 2004.

While I had been in close proximity to Bertie Ahern in 2005/06 as part of a Special Garda Operation and again in 2013 in relation to a money-laundering operation, It would not be until December, 2019, that I would get an opportunity to ask Bertie Ahern why he had directed Garda Commissioner, Pat Byrne, not to arrest Michael McKevitt and the Omagh Bomb Team before the Banbridge and Omagh Bombs in 1998, and rather chose to send his advisor Martin Mansergh for tea and biscuits with Michael McKevitt and the Omagh Bomb Team.

Bertie Ahern told me that, Phil Flynn, Martin McGuinness, Gerry Adams and Caoimhghín Ó Caoláin (Runner for PIRA Chief of Staff, Kevin McKenna) advised him not to arrest McKevitt and the would-be Bombers for fears such arrests could undermine Adams and McGuinness.

Bertie Ahern, was also aware that in the run up to The Good Friday Agreement and beyond, Sinn Fein/Provisional IRA could at any time call the Fianna Fail government out on its abandonment of Articles 2 and 3 of Bunreacht na hEireann, which laid claim to Northern Ireland.

Although Sinn Fein/PIRA had also agreed to the abandonment of Articles 2 and 3 they would in such circumstances simply deny having agreed to such abandonment. Bertie Ahern was prepared to do whatever it took to keep his political position.

On 21 December, 2022, Bertie Ahern’s key-advisor on Northern Ireland, Dr Martin Mansergh told RTÉ documentary Two Tribes, about Ahern’s concerns about Sinn Fein/Provisional IRA in 1998, the potential dual positions of Sinn Fein/Provisional IRA, arose over concerns in The Irish Republic about the removal of articles 2 and 3 of The Constitution, which made claim to Northern Ireland.

Such political duplicity was not uncommon for Sinn Fein/Provisional IRA, and a good example was in 2011, when Martin McGuinness welcomed Queen Elizabeth in Belfast, while Gerry Adams went on RTE Television and stated that Queen Elizabeth was not welcome in The Irish Republic.

Mr Mansergh, who was an adviser during the peace process, said Sinn Féin's planned opposition to the accord in the Republic had worried Bertie Ahern and his government.

"They did contemplate supporting the referendum in the north and opposing it in the south, they had literature printed against the changes to articles 2 and 3," Dr Mansergh said.

The documentary linked the "nervousness" within the Republic's government to the decision by the then Taoiseach Bertie Ahern to release four PIRA prisoners known as the Balcombe Street gang.

On their release the four men then appeared at a Sinn Féin Ard Fheis supporting the Good Friday Agreement.

Mr Ahern told the RTE program: "I took the decision that we should release the Balmcombe Street prisoners who had been sent back from England on the transfer of prisoners act".

"They were released in the afternoon and turned up at the Ard Fheis. I think the euphoria made sure we got across the line".

If Bertie Ahern had directed Garda Commissioner, Pat Byrne to arrest Michael McKevitt and his bomb team prior to Omagh, this could have been done on the 'Belief' evidence of a Garda Superintendent. If McKevitt and his bomb team had been taken out of circulation neither the Banbridge nor the Omagh Bomb would have happened.

Bertie Ahern lied to Dail Eireann in 2002 about his knowledge of The Real IRA pre-Omagh:

Nov 2002 - https://www.irishexaminer.com/news/arid-30075592.html

Oct 2003 - https://www.independent.ie/irish-news/ahern-admits-real-ira-talks-25926350.html

Bertie Ahern mislead Dail Eireann, when asked if he had directed his Special Advisor, Dr Martin Mansergh to meet with The Real IRA prior to the Omagh Bomb in 1998, this meeting was directed after the Government had been advised by me of an imminent bombing campaign, Banbridge and Omagh.

One-year, 14 October, 2003, after misleading Dail Eireann, The Taoiseach, Bertie Ahern, said that his then special adviser Dr Mansergh:

"Did have contact with the 32-County Sovereignty Movement in 1998, some weeks before the Omagh atrocity and with a view to persuading the Real IRA to cease their activities".

"Regrettably the Real IRA did not heed this message and, indeed, subsequently resumed their activities," he said. He reiterated that there was "no 'deal' done by the Government either directly or indirectly" with the Real IRA in return for a ceasefire or in seeking their disbandment.

This attitude, to the Truth, by Bertie Ahern, is in stark contrast to the findings of The Garda Síochána Ombudsman Commission (GSOC), in relation to dealing other Real IRA actions.

Mr Ronan, MacLochlainn, a member of The Real IRA, was killed during an attempted armed robbery of a Securicor van in Ashford, Co Wicklow in May 1998.

"This would have encouraged recognition by its members of the need for accountability and real independence in an investigation," the report says, in addition to possibly prompting better records and systems being maintained, which "ensured that full and appropriate disclosure was made by the organisation and thereby minimised the potential for theories of wrongdoing to fester".

"These measures could have saved the family of Mr MacLochlainn the long ordeal of seeking answers that this process became," the report said.

Michael McKevitt was very clear about what had transpired between Bertie Ahern and The Real IRA Leadership, post-Omagh, McKevitt said that an Amnesty had been offered to The Omagh Bombers and those who directed them in return for a cease-fire.

The Real IRA called a ‘cease-fire’ in September 1998 to consider Ahern’s offer, but concluded that the offer had only been made as the security forces and members of The Irish Government had prior knowledge of The Real IRA plan to bomb Omagh.

NOTE: Bertie Ahern does not say that no deal was offered, simply that no 'deal' was done.

In 1999, when Sinn Fein/Provisional IRA in Belfast, murdered a young man, Charles Bennett, who had been Raped by a senior member of Sinn Fein/PIRA, Bertie Ahern said:

"Until there is an acceptable police force in Northern Ireland these things will continue to happen".

Here again we find Bertie Ahern reading from the same script, "Internal House-keeping", as Secretary of State for Northern Ireland, Mo Mowlam, a script written by MI6.

Sinn Fein/Provisional IRA admitted after the Omagh Bomb, that it was only in the aftermath of the Omagh atrocity that they visited the homes of Real IRA members and directed them not to take any further explosives and weapons from their arms dumps, the dumps were already empty.

This post-Omagh act proving beyond doubt that Sinn Fein/PIRA were happy to use The Real IRA as Proxies, until that tactic literally blew-up in their face with the Omagh atrocity.

Note: Sinn Féin is holding to its position that it will not encourage republicans to provide information to either An Garda Siochána or the Police Service of Northern Ireland (PSNI) on who was responsible for the Omagh bombing four years ago (Gerry Moriarty, Irish Times, Fri, Aug 16, 2002).

Notes: In 1991, the Fianna Fáil–Progressive Democrats program for government was reviewed. Bertie Ahern was a key player in these talks yet again. His involvement prompted Provisional IRA Gun-runner, Charles Haughey to remark of Ahern:

“He's the most skilful, the most devious, the most cunning of them all”.

During 1993, while he was Finance Minister, Ahern accepted payments of IR £39,000 from various businessmen, these were corrupt payments and confirmed as such to me by Paddy Reilly AKA Paddy the Plaster, who would appear before The Mahon Tribunal.

In July, 1997, Charles Haughey gave evidence to the McCracken Tribunal on corruption confirming that he had received IR£1.3 million (€1.7 million) in gifts from businessman Ben Dunne, which he had previously denied. This damaged Haughey's reputation beyond repair.